PEAK INVESTMENTS

PEAK INVESTMENTS

PEAK INVESTMENTS

Tier 1 — HYS

Hands-Off Capital Growth

Minimum allocation: From $3000

Commitment: 2 months

Focus: Long-term capital growth

Management: Fully managed trading

Availability: Limited allocations per cycle

HYS is our core offering for investors who want a set-and-forget approach with clear structure and professional execution.

This tier is best suited for those who:

Prefer a passive investing experience

Value consistency over short-term gains

Want clarity without constant involvement

👉 View HYS Details

Allocation cycles, structure, and availability shared privately

Short-Term Option — Quick Flip

Fixed 2-Week Trading Cycle

Minimum allocation: From $300

Commitment: 2 weeks

Profit structure: 50/50 profit share

Risk profile: Higher due to shorter timeframe

Fast Flip is designed for investors seeking:

A short-term opportunity

A lower-commitment way to experience our execution

A defined start and end date

Because of the lower entry point and shorter duration, Quick Flip carries a higher risk profile and is best suited for smaller allocations or short-term objectives.

👉 See the Current 2-Week Cycle

Live updates and performance shared privately

Advanced Allocation Options

For Serious & Institutional-Style Capital

We also operate higher-tier allocation options for qualified investors.

Tier 2 — Premier Access Fund

Designed for serious investors seeking higher allocation limits and extended trading cycles.Tier 3 — Summit Legacy Fund

Invitation-only. Bespoke capital management.

Limited to 5 clients per cycle.

These tiers are capacity-restricted and not always open.

👉 Access Allocation Information

Availability and qualification shared privately

Prefer to Observe First?

If you’d rather place your own trades or simply see how we operate before considering any allocation, you’re welcome to join our free XAUUSD Telegram channel.

Inside, we share:

Trade ideas

Market commentary

Performance updates

No obligation. No pressure.

👉 Join the Free XAUUSD Channel

A Note on Access & Availability

We operate on a capacity-based model.

Not every option is available at all times, and we prioritise fit over volume.

All allocation details, updates, and availability are shared privately via Telegram.

Tier 1 — HYS

Hands-Off Capital Growth

Minimum allocation: From $3000

Commitment: 2 months

Focus: Long-term capital growth

Management: Fully managed trading

Availability: Limited allocations per cycle

HYS is our core offering for investors who want a set-and-forget approach with clear structure and professional execution.

This tier is best suited for those who:

Prefer a passive investing experience

Value consistency over short-term gains

Want clarity without constant involvement

👉 View HYS Details

Allocation cycles, structure, and availability shared privately

Short-Term Option — Quick Flip

Fixed 2-Week Trading Cycle

Minimum allocation: From $300

Commitment: 2 weeks

Profit structure: 50/50 profit share

Risk profile: Higher due to shorter timeframe

Fast Flip is designed for investors seeking:

A short-term opportunity

A lower-commitment way to experience our execution

A defined start and end date

Because of the lower entry point and shorter duration, Quick Flip carries a higher risk profile and is best suited for smaller allocations or short-term objectives.

👉 See the Current 2-Week Cycle

Live updates and performance shared privately

Advanced Allocation Options

For Serious & Institutional-Style Capital

We also operate higher-tier allocation options for qualified investors.

Tier 2 — Premier Access Fund

Designed for serious investors seeking higher allocation limits and extended trading cycles.Tier 3 — Summit Legacy Fund

Invitation-only. A bespoke allocation structure designed for a small number of long-term capital partners.Extended commitment periods

Highly limited capacity

Private onboarding by invitation only

These tiers are capacity-restricted and not always open.

👉 Access Allocation Information

Availability and qualification shared privately.

Prefer to Observe First?

If you’d rather place your own trades or simply see how we operate before considering any allocation, you’re welcome to join our free XAUUSD Telegram channel.

Inside, we share:

Trade ideas

Market commentary

Performance updates

No obligation. No pressure.

👉 Join the Free XAUUSD Channel

A Note on Access & Availability

We operate on a capacity-based model.

Not every option is available at all times, and we prioritise fit over volume.

All allocation details, updates, and availability are shared privately via Telegram.

Structured capital growth — without the stress of active trading.

HYF is built for investors who want exposure to Forex without managing trades themselves.

Our approach is disciplined, time-bound, and capacity-based — designed to let your capital work while you stay focused on everything else.

We operate a tiered capital allocation model, offering different levels of access depending on capital size, timeframe, and objectives.

How It Works

You choose an allocation level.

We manage the trading.

You stay informed — without needing to be involved day-to-day.

No chart watching. No emotional execution. No need to “stay on top of the market.”

Just a clear structure and defined timeframes.

Structured capital growth — without the stress of active trading.

HYS is built for investors who want exposure to Forex without managing trades themselves.

Our approach is disciplined, time-bound, and capacity-based — designed to let your capital work while you stay focused on everything else.

We operate a tiered capital allocation model, offering different levels of access depending on capital size, timeframe, and objectives.

How It Works

You choose an allocation level.

We manage the trading.

You stay informed — without needing to be involved day-to-day.

No chart watching. No emotional execution. No need to “stay on top of the market.”

Just a clear structure and defined timeframes.

A Hands-Off Way to Access Forex Markets

A Hands-Off Way to Access Forex Markets

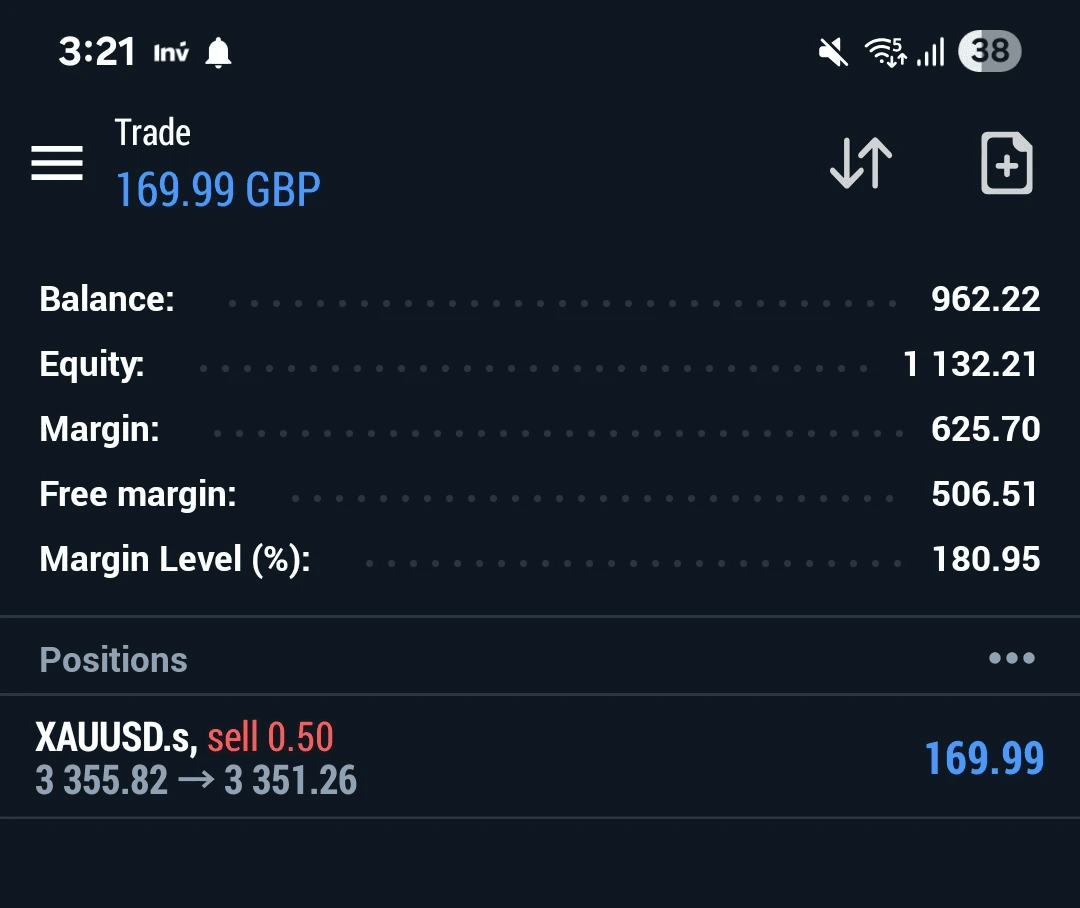

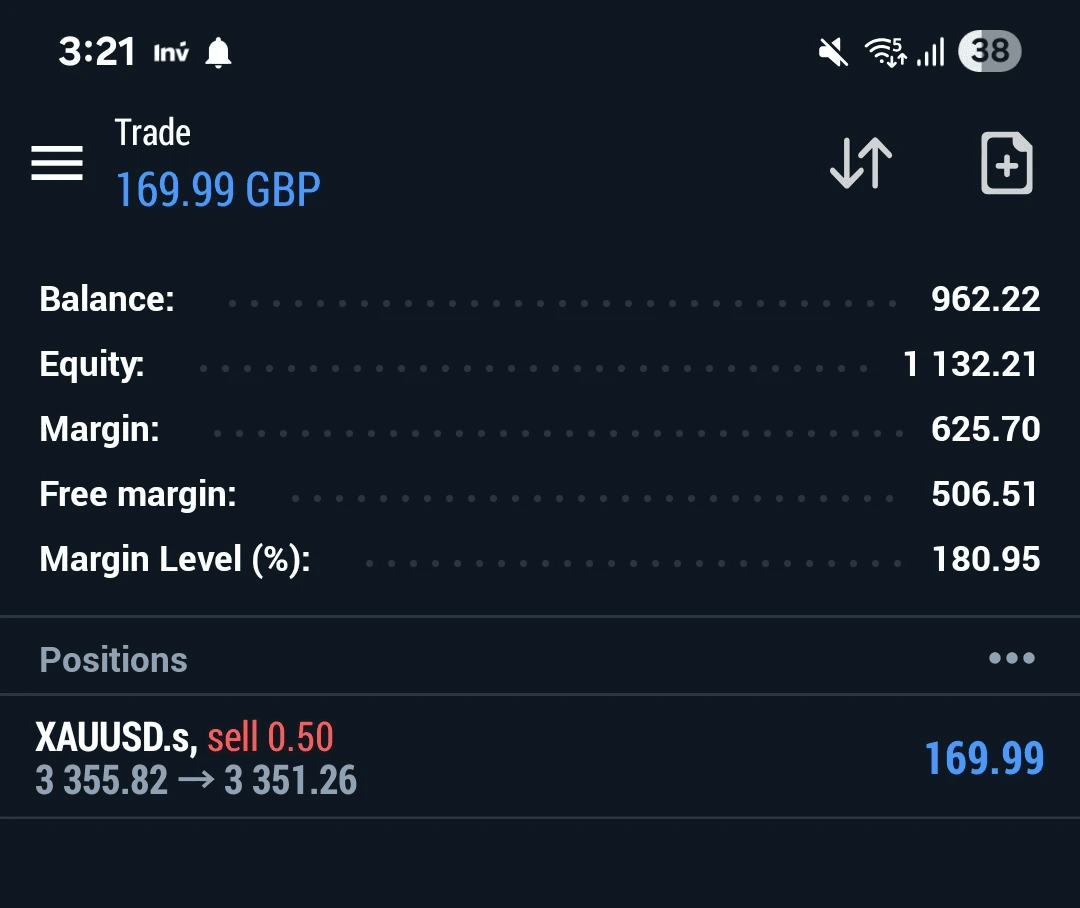

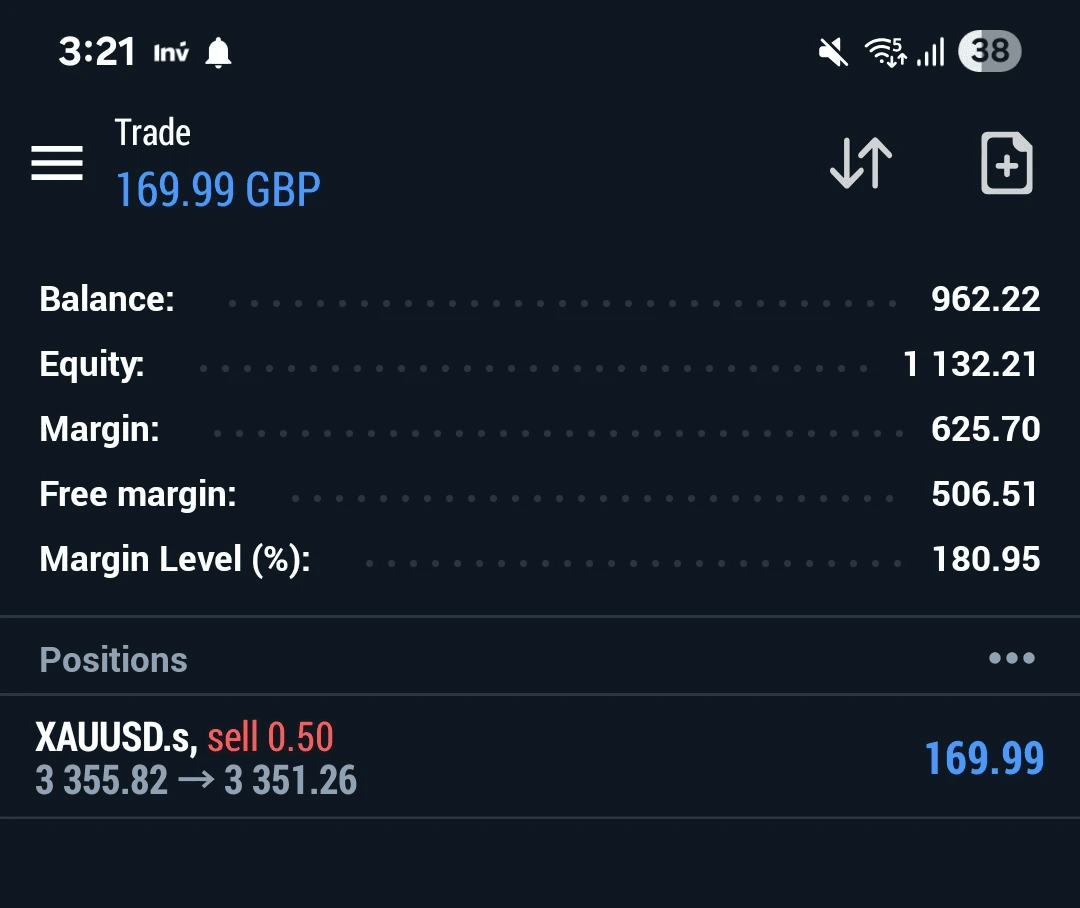

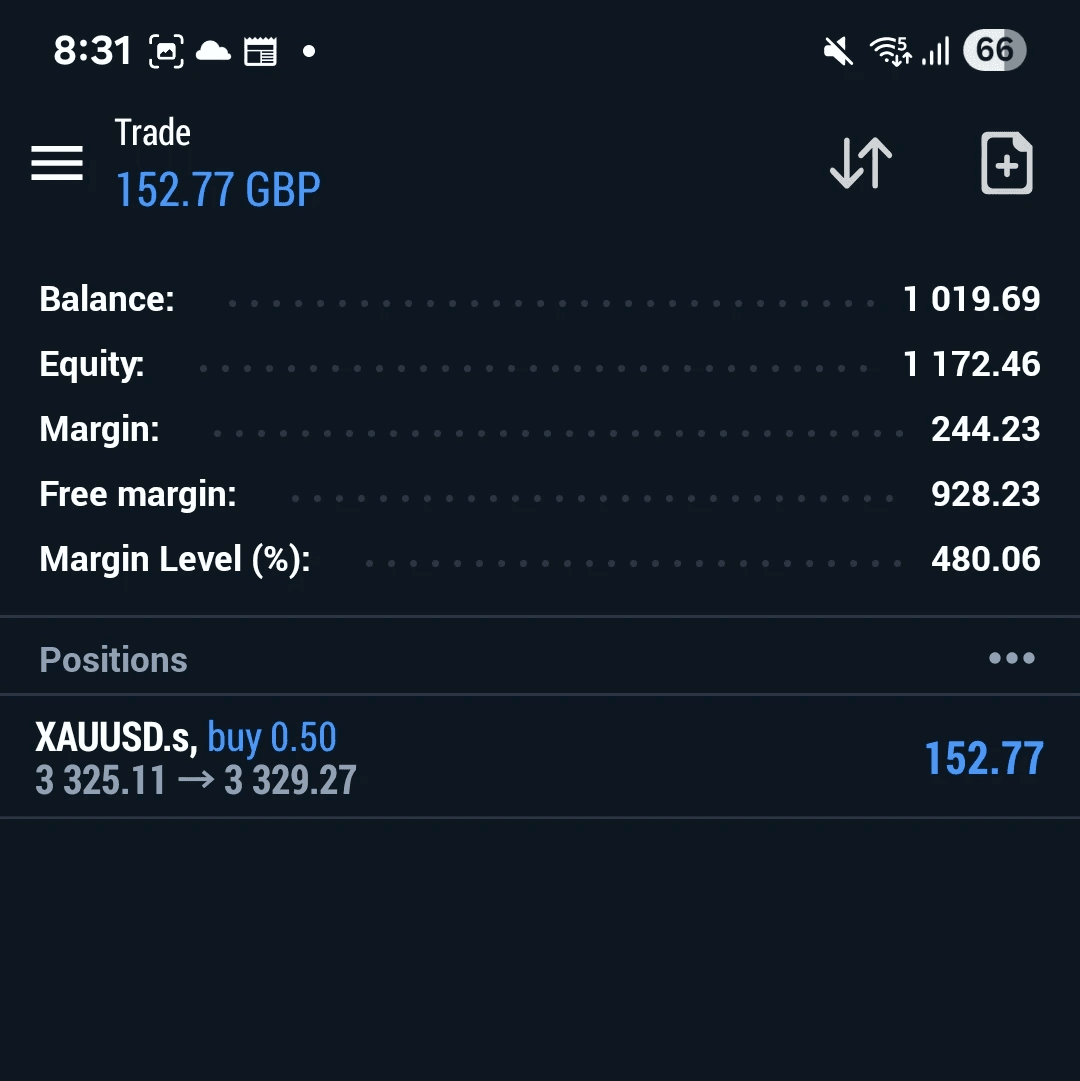

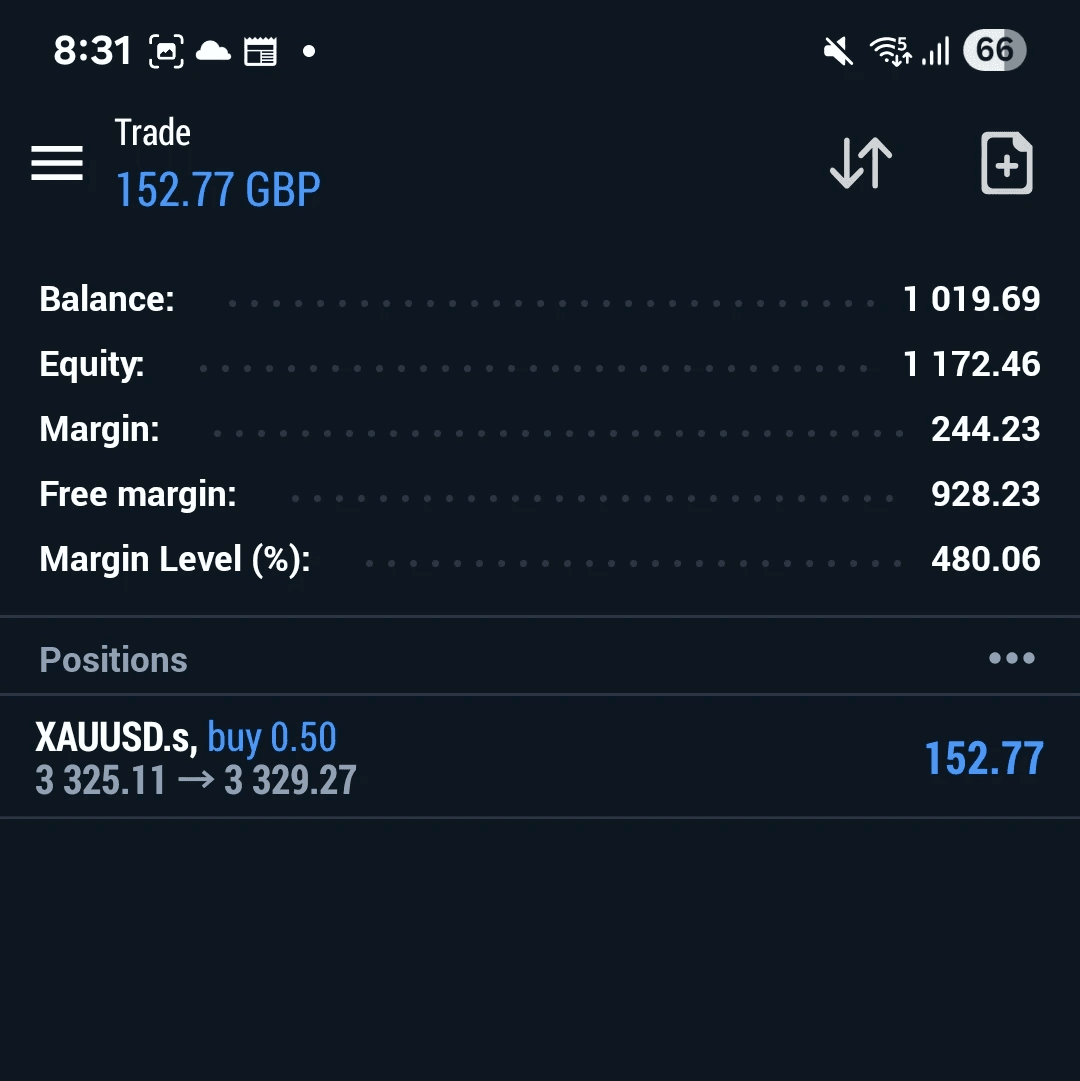

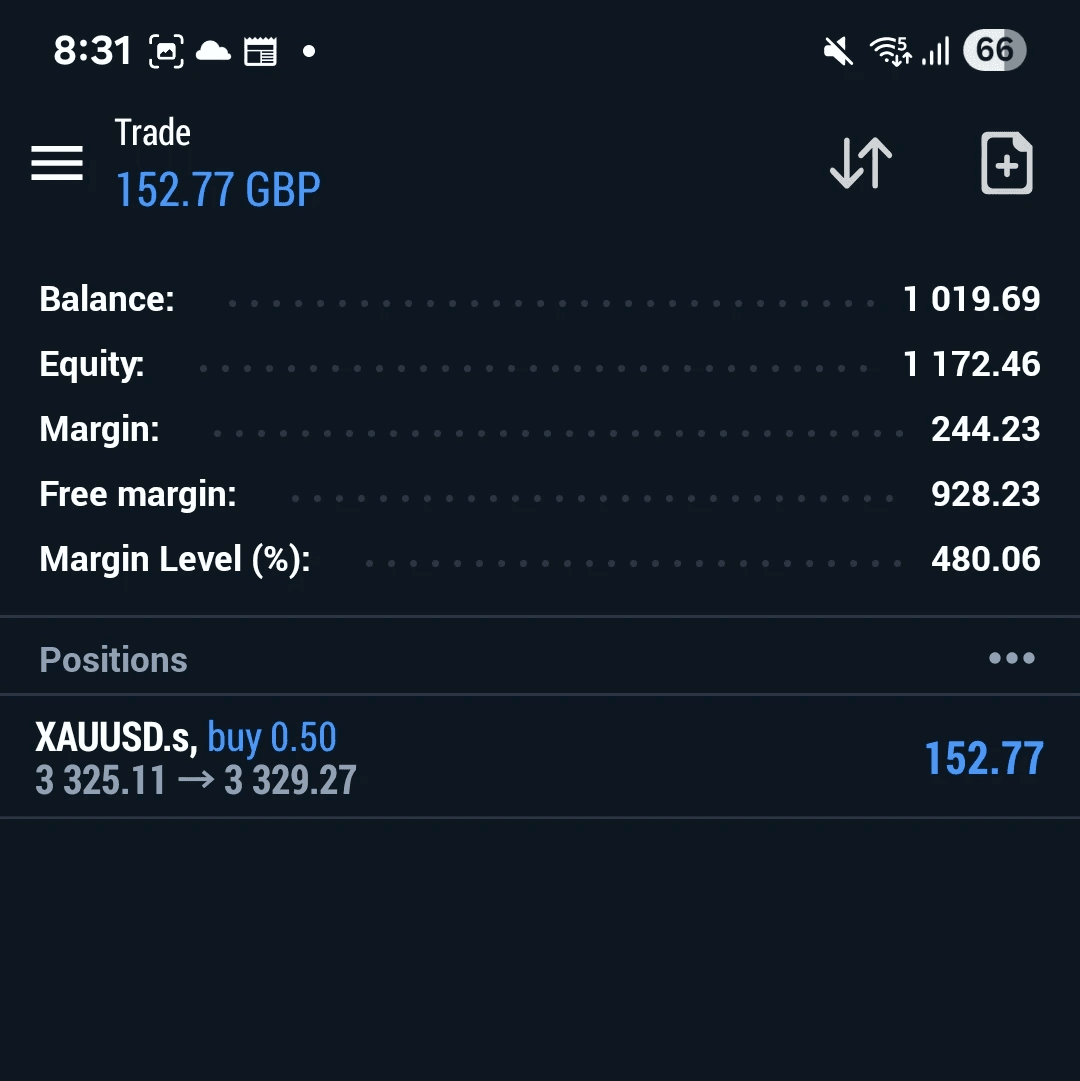

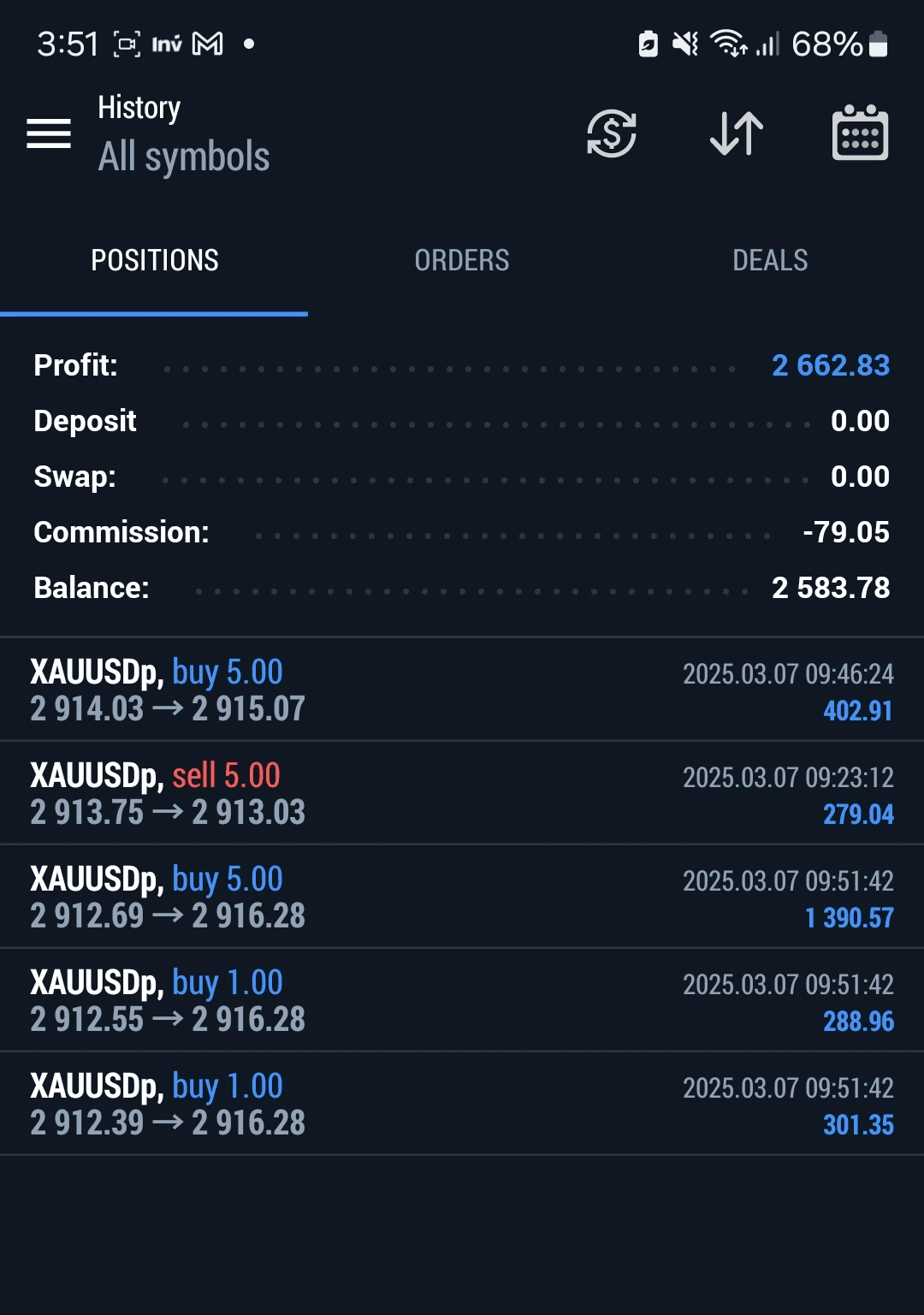

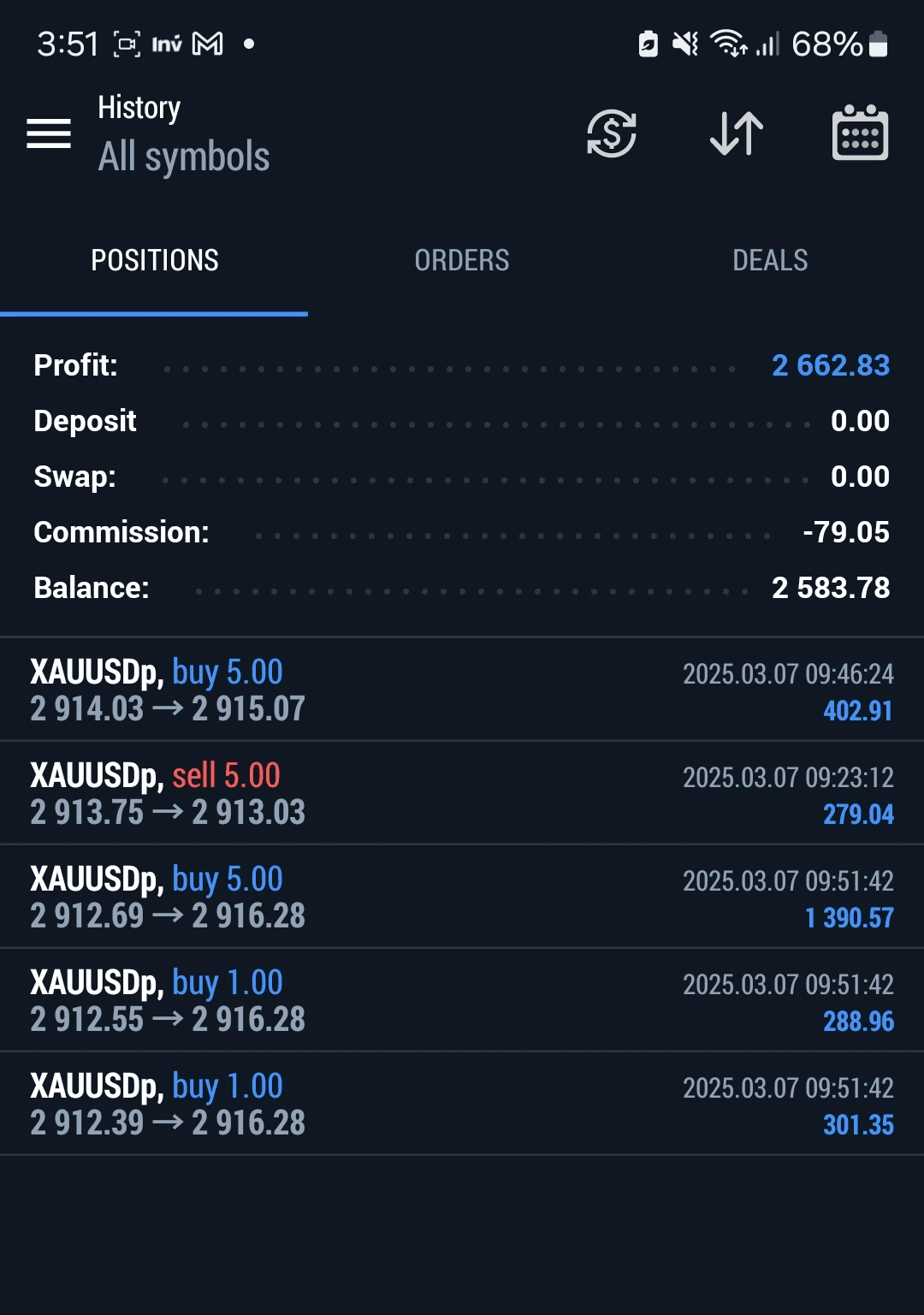

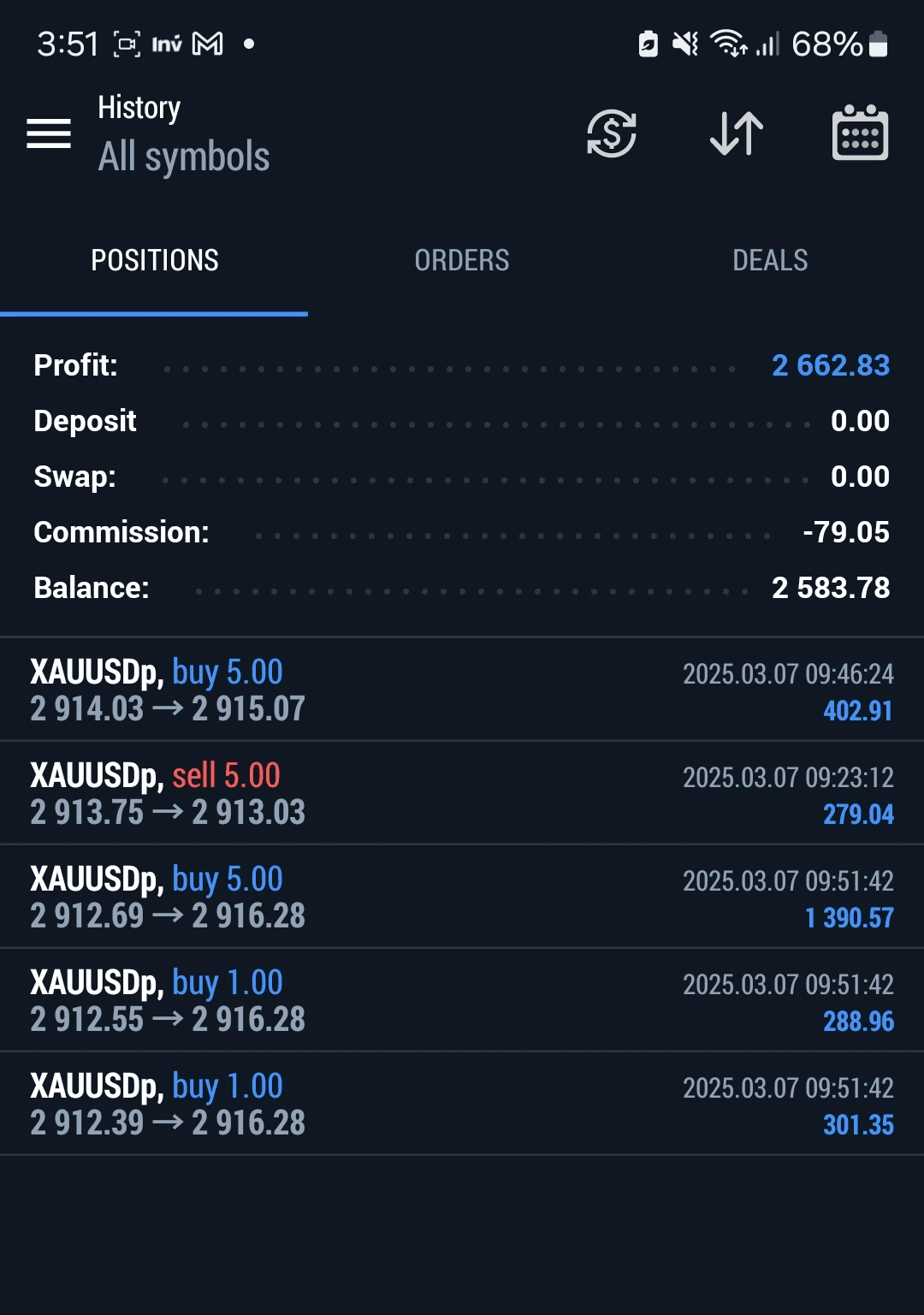

Below are some of my worst results

Disclaimer: Past performance is not indicative of future results. Trading involves risk, including the potential loss of capital. Results shared are for informational purposes only and reflect historical performance, which may vary.

Below are some of my worst results

Disclaimer: Past performance is not indicative of future results. Trading involves risk, including the potential loss of capital. Results shared are for informational purposes only and reflect historical performance, which may vary.

Risk Disclosure

Forex trading involves risk and is not suitable for all individuals. Past performance does not guarantee future results.

Participation in our programs involves allocating capital to be traded according to our strategy. Returns are not fixed and profits, where generated, are shared based on agreed terms.

The entry-level $300 profit participation option is a higher-risk program and should not be considered a substitute for long-term investment capital.

Clients should only allocate funds they can afford to lose and are encouraged to fully understand the structure of each program before participating.

Risk Disclosure

Forex trading involves risk and is not suitable for all individuals. Past performance does not guarantee future results.

Participation in our programs involves allocating capital to be traded according to our strategy. Returns are not fixed and profits, where generated, are shared based on agreed terms.

The entry-level $300 profit participation option is a higher-risk program and should not be considered a substitute for long-term investment capital.

Clients should only allocate funds they can afford to lose and are encouraged to fully understand the structure of each program before participating.

Risk Disclosure

Forex trading involves risk and is not suitable for all individuals. Past performance does not guarantee future results.

Participation in our programs involves allocating capital to be traded according to our strategy. Returns are not fixed and profits, where generated, are shared based on agreed terms.

The entry-level $300 profit participation option is a higher-risk program and should not be considered a substitute for long-term investment capital.

Clients should only allocate funds they can afford to lose and are encouraged to fully understand the structure of each program before participating.